On this post I want to consolidate everything I’ve learned and posted so far on the subject of piling cash. The past posts have focused on my own journey and helping maintenance technicians get their money right. So, on this post I want to include everyone who has a day job. You! You can do this!

There’s nothing worse than clicking on a link and hoping to get quick answers only to find out that they’re trying to sell you a course for $199.00. Or, they are trying to get you to read nothing but fluff. A bunch of statements and feel good platitudes and that’s about it. I hate fluff!! There will be no fluff and no course selling here. So, let’s jump right in!

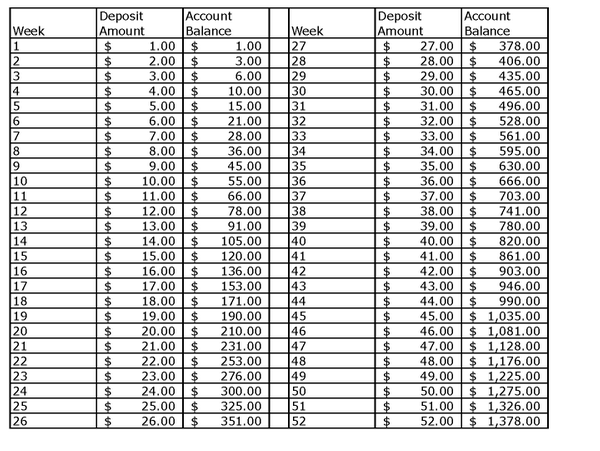

The 52 Week Money Challenge

If you’ve followed my blog at all then you’ve probably seen this a few times. I like this money piling strategy mostly because you can start this right now. As in today. It’s the easiest way to get the juices flowing. Piling cash is 80% discipline and 20% head knowledge. The 52 week money challenge is all about discipline and getting into the habit of putting something away every week.

You can do it however you want! I’ve had some people tell me that they start backwards. Meaning, they started at $52.00 instead of $1.00. That way it got easier as they went along. My wife and I start with $1.00 and only go to $30.00. Once we hit week 30, we just finish out the year throwing $30.00 onto the pile. And, we still end up with a combined total of $2,190!

You can do it however you want to do it. The key is to just do something. Most people are not putting anything away. As you can see, if you do all 52 weeks you’ll end up with $1,378. And $2,756 if your spouse does it with you. Stick with it for 4 years and you’ll have $11,000. Noice! If you choose to do the 52 week money challenge, I recommend that you save the picture above and make it a screen saver on your phone so that you’ll remember to put that week’s amount into the pile.

The $5.00 Bill Challenge

I am currently in the middle of this one and it’s a lot of fun. Anytime you get a $5.00 bill, you put it away. That’s all there is to it! There’s not really much structure with this strategy and you’ll have no idea how much you’ll end up with in a year. However, you’ll be surprised how many times someone hands you a $5.00 bill at a store when you get change back after a purchase. I’ve trained my mind to look at $5.00 bills like they’re baseball cards that I’m collecting. It’s made the challenge easier. If you combine the 52 week money challenge with the $5.00 bill challenge then you’re going to be piling cash at an incredible rate!

Save The First Hour Of Every Work Day

This money saving strategy is like steroids to your bank account. It’s going to get thick in a short period of time. All you have to do is save the first hour of every work day. For example, if you earn $16.00 an hour, then that’s what you’ll be saving every single work day. So, that’s $160 you’ll take out of every 2 week paycheck. Stick with it for the whole year and you’ll have $4,160 at the end of the year. Do this for only 3 years and you’ll have $12,480!

Doesn’t that seem worth it? What do you mean you can’t afford to save the first work hour, cigarette breath? What do you mean you can’t afford to do this, Starbucks breath? What do you mean you can’t afford to do this, Mr. “I’m hungover and spent $100 at the bar last night” breath!? I think you’re catching my drift. You can suffer the pain of discipline or you can suffer the pain of regret. Stop investing in instant gratification and start investing in what matters. Your family and yourself.

Live On 70% Of Your Income

This strategy comes from a great book called ‘The Richest Man In Babylon’. All you do is multiply how much you’re going to make for the year by 70%. For example, if you’re going to earn $40,000 after taxes in a year. That’s 40,000 x 70% = $28,000. So, you’ll pay bills and live on $28,000 and save $12,000. What do you do with the $12,000 you saved? According to the ‘The Richest Man In Babylon’, you save it and invest it. I’ll talk a little about investing in a bit.

Side Hustles

I strongly recommend that you get some side hustles going. Side hustles will accelerate your cash piling. You can google, “Side hustle ideas” and find something you might be interested in doing. With the internet these days it’s easier than ever to work full-time on your living and part-time on your fortune. I’ve read about people who started a side hustle and 4 years later they were making more money doing their side hustle than they were making at their full-time job. For side hustle ideas and motivation you can read books like, ‘Side Hustle: From Idea To Income In 27 Days’, by Chris Guillebeau. Another great book by Chris Guillebeau is called, ‘The $100 Startup: Reinvent The Way You Make A Living’. Those 2 books are great starters on your journey toward working full-time on your living and part-time on your fortune. And if you’d like to start a vlog or do any side hustling on the internet, then you HAVE to read, ‘Crush It!’ by Gary Vaynerchuk. That book changed my life.

Investing

When you get the ball rolling and your cash is piling up, I highly recommend that you start investing. Keep an emergency fund in your savings account that you can get to anytime. I like to keep 6 months of expenses in my savings account. I just add up how much it would take to live for 6 months if I couldn’t work and I wasn’t earning a paycheck for some reason. I keep that amount in my savings. Anything over that gets invested. Now, to keep the trolls from accusing me of “advertising a company because they pay me,” I’m not going disclose my investments. However, every recent book about finance that I’ve read so far says that Vanguard is the best. Especially Vanguard index funds. I read a book about Warren Buffet (one of the richest men in the world) and he said that when he passes away, he’d like his investments to be placed in Vanguard index funds. When a pro investor like Warren Buffet says something, it’s best to take the advice.

I’m not a professional so I will go no further on the subject of investing. But please don’t let investing intimidate you. Find a good financial adviser in your area that has good reviews and just go for it. And, if possible have the money auto drafted from your checking account so that you don’t see it. Stay patient and stay in it for the long haul and you’ll be shocked at the power of compound interest. You can Google and research compound interest if you’re unfamiliar with the term. Oh, and in case you’re wondering, no, I haven’t invested with Vanguard…yet.

Conclusion

You made it! No fluff and no pandering for you to buy a course for only three easy payments of $99.00. Just straight, easy, and practical money piling strategies. And the best part is you can start this very minute. You can find $1.00 in coins under your couch cushions and begin the 52 week money challenge right now.

I know the title of this post is, “Easy Ways To Build Wealth While Working A Day Job.” And, I know that snarky hater trolls who think $15,000 in a savings account isn’t wealth will be stopping by to do what they do best. However, it all depends on your opinion about wealth. Everyone’s opinion is different when it comes to wealth. Wealth to me isn’t a mansion by the ocean with a yacht and a fleet of jet skis. Wealth to me is knowing there’s a financial wall around my family. If something happens to my family and I need $6,000 to fix it, I’ve got it. If I want to have an awesome Christmas and it’s going cost me $2,500 for it, I can do it. If I want to take my wife on an extravagant vacation that’s going to cost $4,000, I’ve got it covered. That to me is wealth, my friend.

Before we part I’d like to recommend reading. Reading can save you five years from the struggles of trial and error. Instead of making the mistakes yourself, you can learn from the mistakes of others through reading about them. If you just do not have the time, you can download audiobooks from AMAZON AUDIBLE and turn your car into a rolling university. I do that as well! Have someone read books to you while driving to and from work.

If you’re not sure where to start, here’s a link to my top 5 books about money. Those 5 books changed me and my bank account tremendously. And remember, the only way things will get better for you is when you get better. You can do this and you do have the time to read and start side hustles. You may need to trade a little TV time to make time for your better future. Stop watching other people’s dream come true on a screen and start working on yours! You can suffer the pain of discipline or you can suffer the pain of regret.

-Related Blog Posts-

How I Started My Financial Journey – link

Multiple Sources Of Income. You Have To Get Gangster! – link

How To Make $1,000 More At Your Day Job Without Asking For A Raise – link

Top 5 Books About Money – link

Disclaimer: Lex Vance is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

This page contains affiliate links, which means that if you click on a link and make a purchase, I’ll receive a small commission. Thank you so much for supporting dirty maintenance nation!