If you’ve hung around my blog or YouTube channel, you know that I’m passionate about apartment maintenance and finance. I know how hard we work and it breaks my heart seeing people who come to the end of their journey with nothing to show for all that hard work. The cuts on our hands, the chapped ass from walking all day, and putting up with the everyday annoyances of our thankless profession. Don’t you want something to show for it all? Here are the easiest ways I’ve found to pile thousands of dollars.

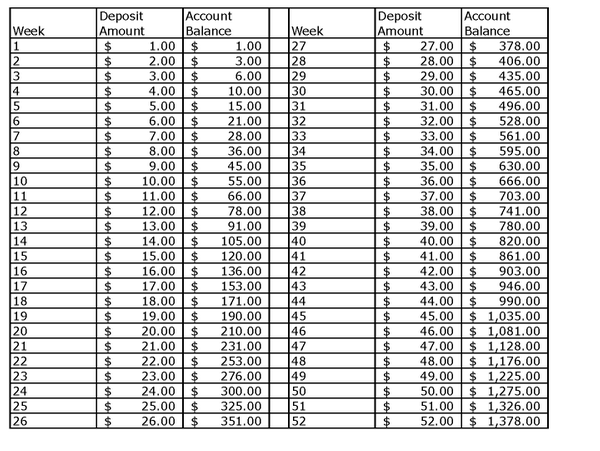

With the New Year upon us, the graph below is a super easy way to get your cash pile started. Begin on January 1st with a single dollar. Like the saying goes, ” A journey of 1,000 miles begins with a single step.”

As you can see, if you go all 52 weeks you’ll end up with $1,378 at the end of the year. If you do it with your spouse, you’ll end up with $2,756 at the end of the year! Hellz yea! If you can’t go all the way to 52, that’s okay. You can stop at a total you’re comfortable with and continue saving weekly. My wife and I have stopped at $30.00 and finished out the year throwing $30.00 each into the envelope. We still ended up with $2,250 at the end of the year. This is the best and easiest way to make money saving a habit. I also recommend saving the graph picture above to your phone’s wallpaper so you’ll see it everyday and remember to put that weeks amount into savings.

$ A Faster Way To Pile More Cash $

If the graph is too slow for you and you want your savings to grow on steroids, then I have a faster way. And that way is to save 1 hour of your pay every day. For example, if you make $16.00 an hour, then you will be putting away $16.00 every day into your savings. So, if you get paid on Friday every 2 weeks. This is what the formula looks like…

$16 x 5 days = $80 a week

$80 x 4 weeks in a month = $320 a month

$320 x 12 months = $3,840 saved in a year

So, if you make $16.00 an hour be sure you take out $160 every 2 weeks. That’s your money! Not Comcast, not Verizon, not Budweisers, but yours!

Pretty amazing when you see it right! Just think, in 3 years you’re going to have $11,520. In just 3 years! Wow!

Wait…. what’s that you say? You can’t afford to save an hour of your pay every day!?

What do you mean you can’t save an hours pay every day frappuccino breath!

What do you mean you can’t save an hours pay every day cigarette breath!

What do you mean you can’t save an hours pay every day Budweiser breath!

What do you mean you can’t save an hours pay every day crippy bud breath!

What do you mean you can’t save an hours pay every day Mr. and Mrs. 5,000 cable channels!

Okay, I think you catch my drift. If you want it bad enough, you’ll find the way to save it. I too use to find every excuse under the sun as to why I couldn’t do it. I use to whine to my drinking buddies about being broke all the time as the bartender handed me my $47.00 bill for the night. That same bill I would pay every weekend.

$47 x 4 = $188 a month

CONCLUSION

Saving money isn’t hard. It’s 80% discipline and 20% head knowledge (common sense). Yet it does take a little sacrifice. You’re going to have to sacrifice a few years for decades of freedom. Now, I’m not talking about a mansion on the hill and the “never have to work again” kind of freedom. Although, if you keep at it and learn how to grow your cash through investing, that kind of freedom is possible. But the kind of freedom I’m talking about is freedom from every day common stresses.

Let’s say that you’ve saved $10,000 and you want to spend $1,000 to give your family an amazing Christmas. You’ve still got $9,000! You ain’t looking too bad! Or, you want to drop $2,000 for an awesome vacation. You’ve still got $8,000. You’re still in the money! Uh oh, you need four new tires on your car. No problem! Now you’re rolling on 4 new tires with $9,200 in the bank. Nice! Or, maybe you need $2,000 to pay bills until you find another job because you finally slammed the keys down on your crappy property manager’s desk and told everyone to kiss your butt. You still got $8,000! Freeeeedoooom!![]()

That’s freedom in my opinion. And also, after a year or two of disciplined saving, you’ll easily be able to replenish the money you’ve taken out because it’s an unconscious habit and you do it without thinking. It’s such a liberating feeling!

If you couldn’t care less about saving money and you’re happy living it up every weekend and living paycheck to paycheck, then great! Continue being awesome! But if you’re stressed out and tired of being broke, this is the way out. You’ll need to separate your wants and your needs for a few years. Just sacrifice a few years for decades of freedom. You can still buy frappuccinos! Just make it a Friday reward and not an every day habit. You can still go out on weekends with your buddies. Just make a once a month reward and not an every weekend thing. And once you have $10,000 in the bank, you’ll be able to afford more weekends out or more frappuccinos now that you’ve got a handle on your finances.

The time is now. Don’t wait until everything’s perfect, just start! You can suffer the pain of discipline, or you can suffer the pain of regret.

NOTE:

Reading has really helped me learn more about finance. I read 2 books a week (1 in my car on CD & 1 physical book) and I can tell you that a lot of books are scammy or just plain fluff trying to sell a magic “Get Rich Quick” product. If you’d like to dive deeper and read some real good helpful books but don’t know where to start, here is a link to, My Top 5 Books About Money.

RELATED TOPICS

HOW A MAINTENANCE MAN SAVED $30,000 IN 4 YEARS – link

HOW I STARTED MY FINANCIAL JOURNEY – link

MULTIPLE SOURCES OF INCOME. YOU HAVE TO GET GANGSTER – link

HOW TO MAKE $1,000 OR MORE A YEAR AT YOUR DAY JOB WITHOUT ASKING FOR A RAISE – link

BOOKS ABOUT REGULAR PEOPLE WITH REGULAR JOBS BECOMING MILLIONAIRES – link

Disclaimer:Lex Vance is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

This page contains affiliate links, which means that if you click on a link and make a purchase, I’ll receive a small commission. Thank you so much for supporting dirty maintenance nation!

Great article, Lex.

Thank you for reading Jim!